Download July Through June Calendar 2019-2020 Ascending

Start Preamble Start Printed Page 39104

AGENCY:

Centers for Medicare & Medicaid Services (CMS), Health and Human Services (HHS).

ACTION:

Proposed rule.

SUMMARY:

This major proposed rule addresses: Changes to the physician fee schedule (PFS); other changes to Medicare Part B payment policies to ensure that payment systems are updated to reflect changes in medical practice, relative value of services, and changes in the statute; Medicare Shared Savings Program requirements; updates to the Quality Payment Program; Medicare coverage of opioid use disorder services furnished by opioid treatment programs; updates to certain Medicare provider enrollment policies; requirements for prepayment and post-payment medical review activities; requirement for electronic prescribing for controlled substances for a covered Part D drug under a prescription drug plan, or a Medicare Advantage Prescription Drug (MA-PD) plan; updates to the Medicare Ground Ambulance Data Collection System; changes to the Medicare Diabetes Prevention Program (MDPP) expanded model; and amendments to the physician self-referral law regulations.

DATES:

To be assured consideration, comments must be received at one of the addresses provided below, no later than 5 p.m. on September 13, 2021.

ADDRESSES:

In commenting, please refer to file code CMS-1751-P. Comments, including mass comment submissions, must be submitted in one of the following three ways (please choose only one of the ways listed):

1. Electronically. You may submit electronic comments on this regulation to http://www.regulations.gov. Follow the "Submit a comment" instructions.

2. By regular mail. You may mail written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS-1751-P, P.O. Box 8016, Baltimore, MD 21244-8016.

Please allow sufficient time for mailed comments to be received before the close of the comment period.

3. By express or overnight mail. You may send written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS-1751-P, Mail Stop C4-26-05, 7500 Security Boulevard, Baltimore, MD 21244-1850.

Start Further Info

FOR FURTHER INFORMATION CONTACT:

DivisionofPractitionerServices@cms.hhs.gov, for any issues not identified below.

Michael Soracoe, (410) 786-6312, for issues related to practice expense, work RVUs, conversion factor, and PFS specialty-specific impacts.

Larry Chan, (410) 786-6864, for issues related to potentially misvalued services under the PFS.

Donta Henson, (410) 786-1947, Patrick Sartini, (410) 786-9252, and Larry Chan, (410) 786-6864, for issues related to telehealth services and other services involving communications technology.

Julie Adams, (410) 786-8932, for issues related to payment for anesthesia services.

Sarah Leipnik, (410) 786-3933, for issues related to split (or shared) services.

Christiane LaBonte, (410) 786-7237, for issues related to indirect practice expense, PFS payment for critical care services, and PFS payment for teaching physician services.

DivisionofPractitionerServices@cms.hhs.gov, for issues related to payment for vaccine administration services.

Regina Walker-Wren, (410) 786-9160, for issues related to billing for services of physician assistants.

Pamela West, (410) 786-2302, for issues related to PFS payment for therapy services, medical nutrition therapy services, and services of registered dieticians and nutrition professionals.

Liane Grayson, (410) 786-6583, and Donta Henson, (410) 786-1947, for issues related to coinsurance for certain colorectal cancer screening services.

Lisa Parker, (410) 786-4949, for issues related to RHCs and FQHCs.

Laura Kennedy, (410) 786-3377, for issues related to drugs payable under Part B.

Heather Hostetler, (410) 786-4515, and Elizabeth Truong, 410-786-6005, for issues related to removal of select national coverage determinations.

Sarah Fulton, (410) 786-2749, for issues related to Appropriate Use Criteria for Advanced Diagnostic Imaging (AUC); and Pulmonary Rehabilitation, Cardiac Rehabilitation and Intensive Cardiac Rehabilitation.

Rachel Katonak, (410) 786-8564, for issues related to Medical Nutrition Therapy.

Fiona Larbi, (410) 786-7224, for issues related to the Medicare Shared Savings Program (Shared Savings Program) Quality performance standard and quality reporting requirements.

Janae James, (410) 786-0801, or Elizabeth November, (410) 786-4518, or SharedSavingsProgram@cms.hhs.gov, for issues related to Shared Savings Program beneficiary assignment, repayment mechanism requirements, and benchmarking methodology.

Naseem Tarmohamed, (410) 786-0814, or SharedSavingsProgram@cms.hhs.gov, for inquiries related to Shared Savings Program application, compliance and beneficiary notification requirements.

Amy Gruber, AmbulanceDataCollection@cms.hhs.gov, for issues related to the Medicare Ground Ambulance Data Collection System.

Juliana Tiongson, (410) 786-0342, for issues related to the Medicare Diabetes Prevention Program (MDPP).

Laura Ashbaugh, (410) 786-1113, for issues related to Clinical Laboratory Fee Schedule: Laboratory Specimen Collection and Travel Allowance and Use of Electronic Travel Logs.

Frank Whelan, (410) 786-1302, for issues related to Medicare provider enrollment regulation updates.

Thomas J. Kessler, (410) 786-1991, for issues related to provider and supplier prepayment and post-payment medical review requirements.

Lindsey Baldwin, (410) 786-1694, and Michele Franklin, (410) 786-9226, for issues related to Medicare coverage of opioid use disorder treatment services furnished by opioid treatment programs.

Lisa O. Wilson, (410) 786-8852, or Meredith Larson, (410) 786-7923, for inquiries related to the physician self-referral law.

Joella Roland, (410) 786-7638, for issues related to requirement for electronic prescribing for controlled substances for a covered Part D drug under a prescription drug plan or an MA-PD plan.

Kathleen Ott, (410) 786-4246, for issues related to open payments. Start Printed Page 39105

Molly MacHarris, (410) 786-4461, for inquiries related to Merit-based Incentive Payment System (MIPS).

Brittany LaCouture, (410) 786-0481, for inquiries related to Alternative Payment Models (APMs).

End Further Info End Preamble

SUPPLEMENTARY INFORMATION:

Inspection of Public Comments: All comments received before the close of the comment period are available for viewing by the public, including any personally identifiable or confidential business information that is included in a comment. We post all comments received before the close of the comment period on the following website as soon as possible after they have been received: http://www.regulations.gov. Follow the search instructions on that website to view public comments. CMS will not post on Regulations.gov public comments that make threats to individuals or institutions or suggest that the individual will take actions to harm the individual. CMS continues to encourage individuals not to submit duplicative comments. We will post acceptable comments from multiple unique commenters even if the content is identical or nearly identical to other comments.

Addenda Available Only Through the Internet on the CMS Website: The PFS Addenda along with other supporting documents and tables referenced in this proposed rule are available on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/index.html. Click on the link on the left side of the screen titled, "PFS Federal Regulations Notices" for a chronological list of PFS Federal Register and other related documents. For the CY 2022 PFS proposed rule, refer to item CMS-1751-P. Readers with questions related to accessing any of the Addenda or other supporting documents referenced in this proposed rule and posted on the CMS website identified above should contact DivisionofPractitionerServices@cms.hhs.gov.

CPT (Current Procedural Terminology) Copyright Notice: Throughout this proposed rule, we use CPT codes and descriptions to refer to a variety of services. We note that CPT codes and descriptions are copyright 2020 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association (AMA). Applicable Federal Acquisition Regulations (FAR) and Defense Federal Acquisition Regulations (DFAR) apply.

I. Executive Summary

This major proposed rule proposes to revise payment polices under the Medicare PFS and makes other policy changes, including proposals to implement certain provisions of the Consolidated Appropriations Act, 2021 (CAA, 2021) (Pub. L. 116-260, December 27, 2020), Bipartisan Budget Act of 2018 (BBA of 2018) (Pub. L. 115-123, February 9, 2018) and the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act (the SUPPORT Act) (Pub. L. 115-271, October 24, 2018), related to Medicare Part B payment. In addition, this major proposed rule includes proposals regarding other Medicare payment policies described in sections III. and IV.

A. Summary of the Major Provisions

The statute requires us to establish payments under the PFS, based on national uniform relative value units (RVUs) that account for the relative resources used in furnishing a service. The statute requires that RVUs be established for three categories of resources: Work, practice expense (PE), and malpractice (MP) expense. In addition, the statute requires that we establish each year by regulation the payment amounts for physicians' services paid under the PFS, including geographic adjustments to reflect the variations in the costs of furnishing services in different geographic areas.

In this major proposed rule, we are proposing to establish RVUs for CY 2022 for the PFS to ensure that our payment systems are updated to reflect changes in medical practice and the relative value of services, as well as changes in the statute. This proposed rule also includes discussions and provisions regarding several other Medicare Part B payment policies.

Specifically, this proposed rule addresses:

- Practice Expense RVUs (section II.B.)

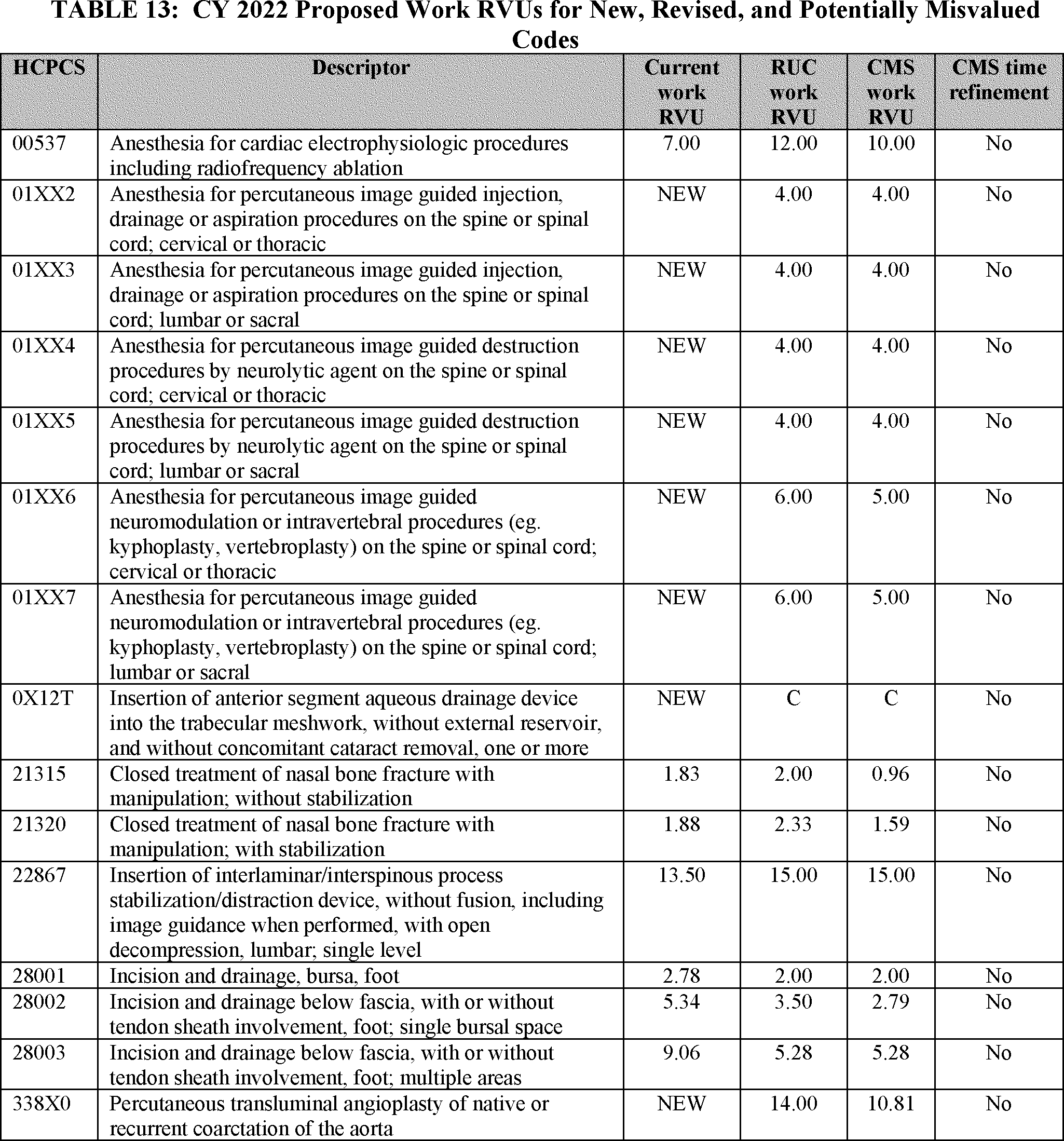

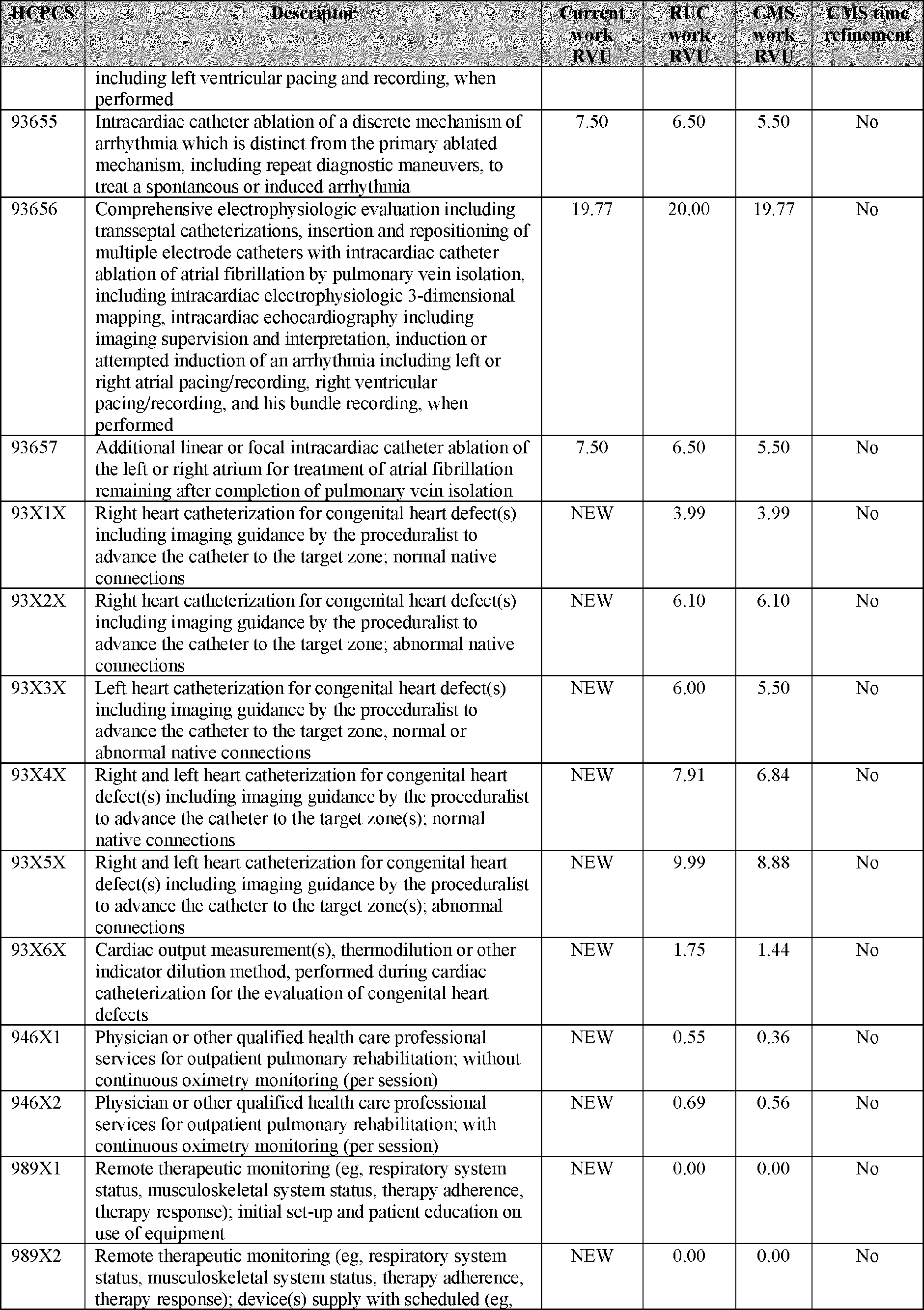

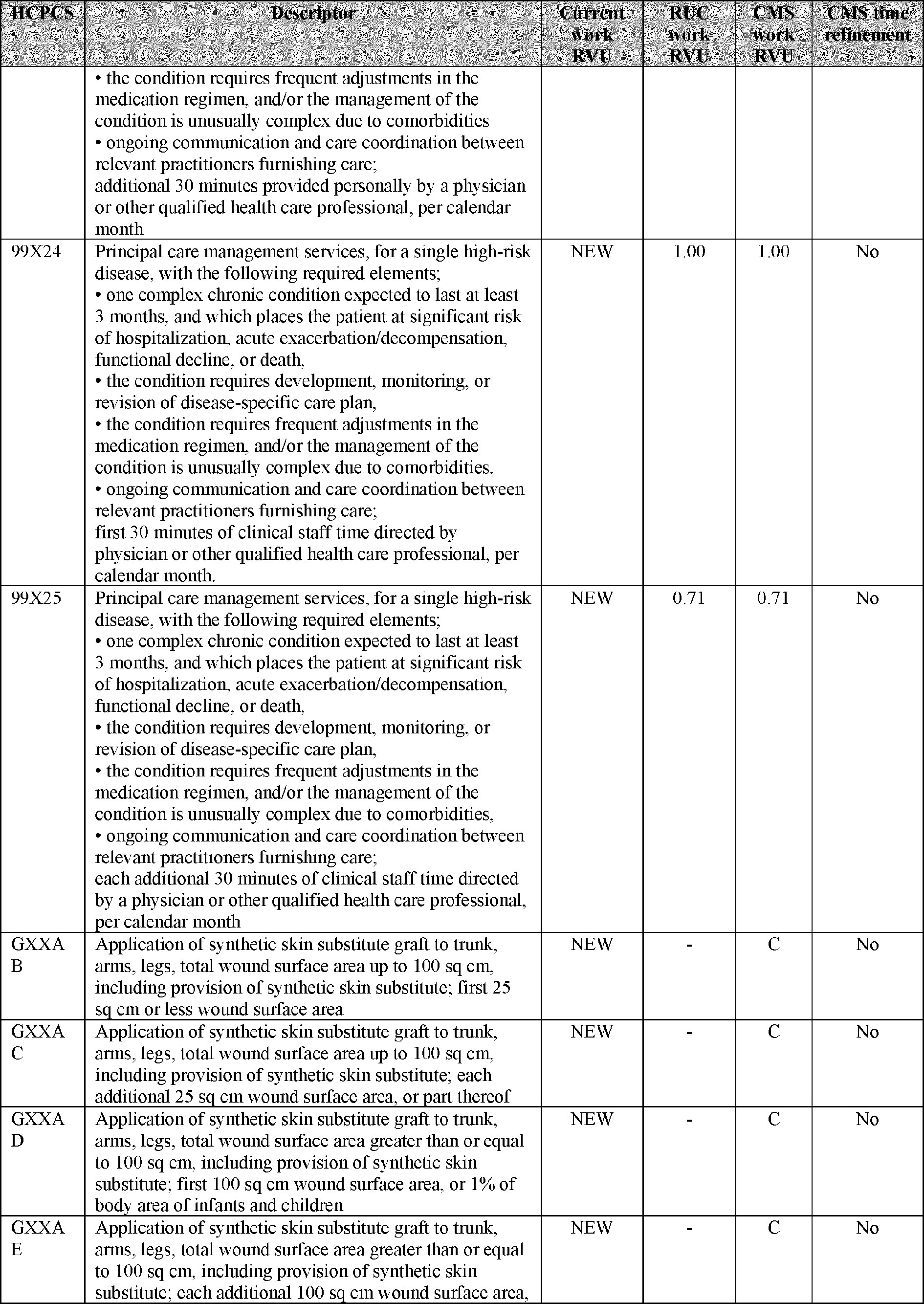

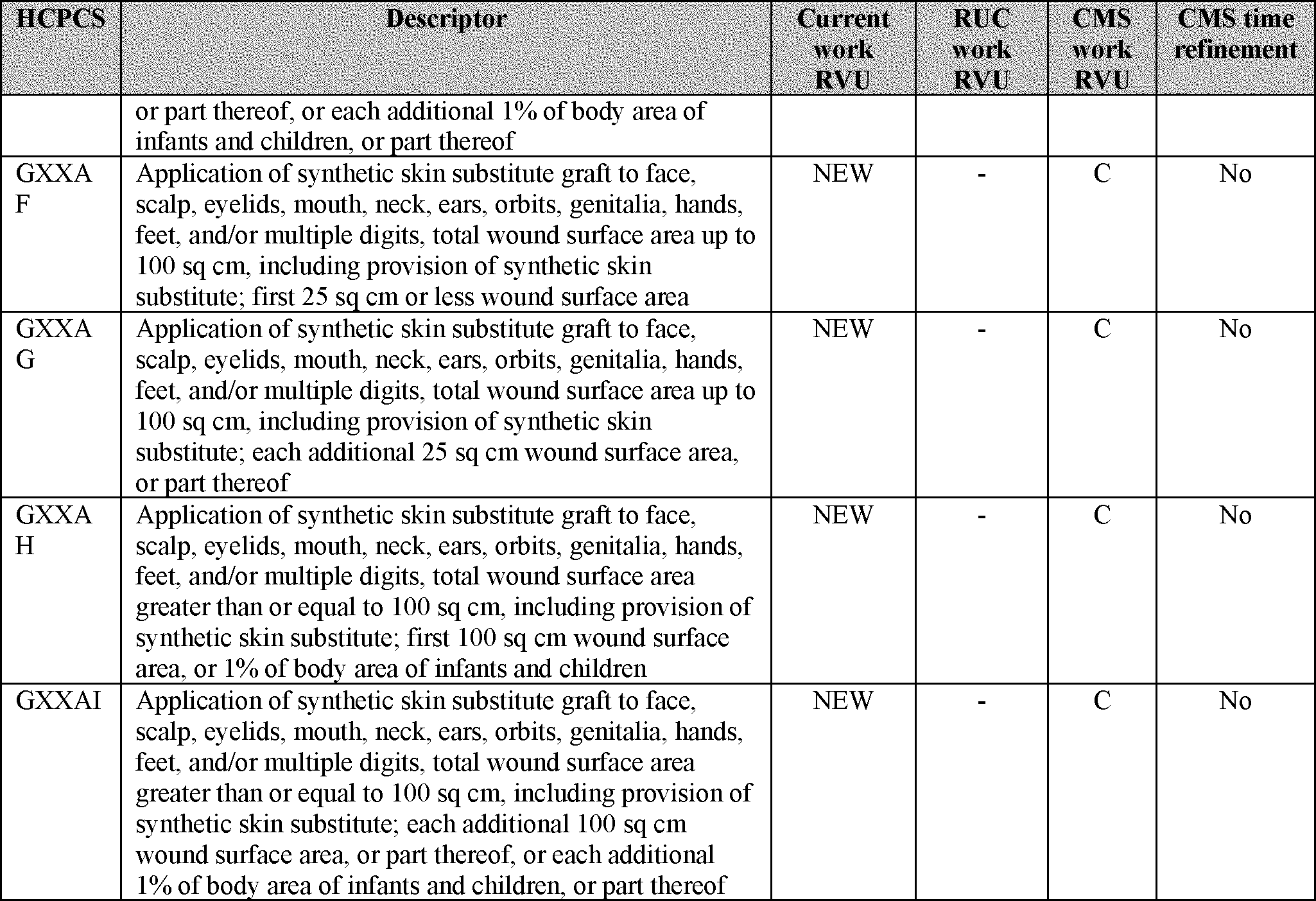

- Potentially Misvalued Services Under the PFS (section II.C.)

- Telehealth and Other Services Involving Communications Technology (section II.D.)

- Valuation of Specific Codes (section II.E.)

- Evaluation and Management Visits (section II.F.)

- Billing for Physician Assistant Services (section II.G.)

- Therapy Services (section II.H.)

- Changes to Beneficiary Coinsurance for Additional Procedures Furnished During the Same Clinical Encounter as Certain Colorectal Cancer Screening Tests (section II.I.)

- Vaccine Administration Services (section II.J.)

- Payment for Medical Nutrition Therapy Services and Related Services (section II.K.)

- Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs) (sections III.A., III.B., and III.C.)

- Requiring Certain Manufacturers to Report Drug Pricing Information for Part B and Determination of ASP for Certain Self-administered Drug Products (sections III.D.1. and 2.)

- Medicare Part B Drug Payment for Drugs Approved under Section 505(b)(2) of the Federal Food, Drug, & Cosmetic Act (section III.E.)

- Appropriate Use Criteria for Advanced Diagnostic Imaging (section III.F.)

- Removal of Select National Coverage Determinations (section III.G.)

- Pulmonary Rehabilitation, Cardiac Rehabilitation and Intensive Cardiac Rehabilitation (section III.H.)

- Medical Nutrition Therapy (section III.I.)

- Medicare Shared Savings Program (section III.J.)

- Medicare Ground Ambulance Data Collection System (section III.K.)

- Medicare Diabetes Prevention Program (MDPP) (section III.L.)

- Clinical Laboratory Fee Schedule: Laboratory Specimen Collection and Travel Allowance for Clinical Diagnostic Laboratory Tests and Use of Electronic Travel Logs (section III.M.)

- Medicare Provider and Supplier Enrollment Changes (section III.N.1.)

- Provider/Supplier Medical Review Requirements: Addition of Provider/Supplier Requirements related to Prepayment and Post-payment Reviews (section III.N.2.)

- Modifications Related to Medicare Coverage for Opioid Use Disorder (OUD) Treatment Services Furnished by Opioid Treatment Programs (OTPs) (section III.O.)

- Updates to the Physician Self-Referral Regulations (section III.P.)

- Requirement for Electronic Prescribing for Controlled Substances for a Covered Part D Drug under a Prescription Drug Plan or an MA-PD Plan (section 2003 of the SUPPORT Act) (section III.Q.)

- Open Payments (section III.R.)

- Updates to the Quality Payment Program (section IV.)

- Collection of Information Requirements (section V.)

- Response to Comments (section VI.)

- Regulatory Impact Analysis (section VII.) Start Printed Page 39106

3. Summary of Costs and Benefits

We have determined that this proposed rule is economically significant. For a detailed discussion of the economic impacts, see section VII., Regulatory Impact Analysis, of this proposed rule.

II. Provisions of the Proposed Rule for the PFS

A. Background

Since January 1, 1992, Medicare has paid for physicians' services under section 1848 of the Social Security Act (the Act), "Payment for Physicians' Services." The PFS relies on national relative values that are established for work, practice expense (PE), and malpractice (MP), which are adjusted for geographic cost variations. These values are multiplied by a conversion factor (CF) to convert the relative value units (RVUs) into payment rates. The concepts and methodology underlying the PFS were enacted as part of the Omnibus Budget Reconciliation Act of 1989 (OBRA '89) (Pub. L. 101-239, December 19, 1989), and the Omnibus Budget Reconciliation Act of 1990 (OBRA '90) (Pub. L. 101-508, November 5, 1990). The final rule published in the November 25, 1991 Federal Register (56 FR 59502) set forth the first fee schedule used for payment for physicians' services.

We note that throughout this proposed rule, unless otherwise noted, the term "practitioner" is used to describe both physicians and nonphysician practitioners (NPPs) who are permitted to bill Medicare under the PFS for the services they furnish to Medicare beneficiaries.

1. Development of the RVUs

a. Work RVUs

The work RVUs established for the initial fee schedule, which was implemented on January 1, 1992, were developed with extensive input from the physician community. A research team at the Harvard School of Public Health developed the original work RVUs for most codes under a cooperative agreement with the Department of Health and Human Services (HHS). In constructing the code-specific vignettes used in determining the original physician work RVUs, Harvard worked with panels of experts, both inside and outside the federal government, and obtained input from numerous physician specialty groups.

As specified in section 1848(c)(1)(A) of the Act, the work component of physicians' services means the portion of the resources used in furnishing the service that reflects physician time and intensity. We establish work RVUs for new, revised and potentially misvalued codes based on our review of information that generally includes, but is not limited to, recommendations received from the American Medical Association/Specialty Society Relative Value Scale Update Committee (RUC), the Health Care Professionals Advisory Committee (HCPAC), the Medicare Payment Advisory Commission (MedPAC), and other public commenters; medical literature and comparative databases; as well as a comparison of the work for other codes within the Medicare PFS, and consultation with other physicians and health care professionals within CMS and the federal government. We also assess the methodology and data used to develop the recommendations submitted to us by the RUC and other public commenters, and the rationale for their recommendations. In the CY 2011 PFS final rule with comment period (75 FR 73328 through 73329), we discussed a variety of methodologies and approaches used to develop work RVUs, including survey data, building blocks, crosswalk to key reference or similar codes, and magnitude estimation. More information on these issues is available in that rule.

b. Practice Expense RVUs

Initially, only the work RVUs were resource-based, and the PE and MP RVUs were based on average allowable charges. Section 121 of the Social Security Act Amendments of 1994 (Pub. L. 103-432, October 31, 1994), amended by section 1848(c)(2)(C)(ii) of the Act and required us to develop resource-based PE RVUs for each physicians' service beginning in 1998. We were required to consider general categories of expenses (such as office rent and wages of personnel, but excluding MP expenses) comprising PEs. The PE RVUs continue to represent the portion of these resources involved in furnishing PFS services.

Originally, the resource-based method was to be used beginning in 1998, but section 4505(a) of the Balanced Budget Act of 1997 (BBA `97) (Pub. L. 105-33, August 5, 1997) delayed implementation of the resource-based PE RVU system until January 1, 1999. In addition, section 4505(b) of the BBA `97 provided for a 4-year transition period from the charge-based PE RVUs to the resource-based PE RVUs.

We established the resource-based PE RVUs for each physicians' service in the November 2, 1998 final rule (63 FR 58814), effective for services furnished in CY 1999. Based on the requirement to transition to a resource-based system for PE over a 4-year period, payment rates were not fully based upon resource-based PE RVUs until CY 2002. This resource-based system was based on two significant sources of actual PE data: The Clinical Practice Expert Panel (CPEP) data; and the AMA's Socioeconomic Monitoring System (SMS) data. These data sources are described in greater detail in the CY 2012 PFS final rule with comment period (76 FR 73033).

Separate PE RVUs are established for services furnished in facility settings, such as a hospital outpatient department (HOPD) or an ambulatory surgical center (ASC), and in nonfacility settings, such as a physician's office. The nonfacility RVUs reflect all of the direct and indirect PEs involved in furnishing a service described by a particular HCPCS code. The difference, if any, in these PE RVUs generally results in a higher payment in the nonfacility setting because in the facility settings some resource costs are borne by the facility. Medicare's payment to the facility (such as the outpatient prospective payment system (OPPS) payment to the HOPD) would reflect costs typically incurred by the facility. Thus, payment associated with those specific facility resource costs is not made under the PFS.

Section 212 of the Balanced Budget Refinement Act of 1999 (BBRA) (Pub. L. 106-113, November 29, 1999) directed the Secretary of Health and Human Services (the Secretary) to establish a process under which we accept and use, to the maximum extent practicable and consistent with sound data practices, data collected or developed by entities and organizations to supplement the data we normally collect in determining the PE component. On May 3, 2000, we published the interim final rule (65 FR 25664) that set forth the criteria for the submission of these supplemental PE survey data. The criteria were modified in response to comments received, and published in the Federal Register (65 FR 65376) as part of a November 1, 2000 final rule. The PFS final rules published in 2001 and 2003, respectively, (66 FR 55246 and 68 FR 63196) extended the period during which we would accept these supplemental data through March 1, 2005.

In the CY 2007 PFS final rule with comment period (71 FR 69624), we revised the methodology for calculating direct PE RVUs from the top-down to the bottom-up methodology beginning in CY 2007. We adopted a 4-year transition to the new PE RVUs. This transition was completed for CY 2010. In the CY 2010 PFS final rule with Start Printed Page 39107 comment period, we updated the practice expense per hour (PE/HR) data that are used in the calculation of PE RVUs for most specialties (74 FR 61749). In CY 2010, we began a 4-year transition to the new PE RVUs using the updated PE/HR data, which was completed for CY 2013.

c. Malpractice RVUs

Section 4505(f) of the BBA `97 amended section 1848(c) of the Act to require that we implement resource-based MP RVUs for services furnished on or after CY 2000. The resource-based MP RVUs were implemented in the PFS final rule with comment period published November 2, 1999 (64 FR 59380). The MP RVUs are based on commercial and physician-owned insurers' MP insurance premium data from all the states, the District of Columbia, and Puerto Rico.

d. Refinements to the RVUs

Section 1848(c)(2)(B)(i) of the Act requires that we review RVUs no less often than every 5 years. Prior to CY 2013, we conducted periodic reviews of work RVUs and PE RVUs independently from one another. We completed 5-year reviews of work RVUs that were effective for calendar years 1997, 2002, 2007, and 2012.

Although refinements to the direct PE inputs initially relied heavily on input from the RUC Practice Expense Advisory Committee (PEAC), the shifts to the bottom-up PE methodology in CY 2007 and to the use of the updated PE/HR data in CY 2010 have resulted in significant refinements to the PE RVUs in recent years.

In the CY 2012 PFS final rule with comment period (76 FR 73057), we finalized a proposal to consolidate reviews of work and PE RVUs under section 1848(c)(2)(B) of the Act and reviews of potentially misvalued codes under section 1848(c)(2)(K) of the Act into one annual process.

In addition to the 5-year reviews, beginning for CY 2009, CMS and the RUC identified and reviewed a number of potentially misvalued codes on an annual basis based on various identification screens. This annual review of work and PE RVUs for potentially misvalued codes was supplemented by the amendments to section 1848 of the Act, as enacted by section 3134 of the Affordable Care Act, that require the agency to periodically identify, review and adjust values for potentially misvalued codes.

e. Application of Budget Neutrality to Adjustments of RVUs

As described in section VII. of this proposed rule, the Regulatory Impact Analysis, in accordance with section 1848(c)(2)(B)(ii)(II) of the Act, if revisions to the RVUs cause expenditures for the year to change by more than $20 million, we will make adjustments to ensure that expenditures do not increase or decrease by more than $20 million.

2. Calculation of Payments Based on RVUs

To calculate the payment for each service, the components of the fee schedule (work, PE, and MP RVUs) are adjusted by geographic practice cost indices (GPCIs) to reflect the variations in the costs of furnishing the services. The GPCIs reflect the relative costs of work, PE, and MP in an area compared to the national average costs for each component. Please refer to the CY 2020 PFS final rule for a discussion of the last GPCI update (84 FR 62615 through 62623).

RVUs are converted to dollar amounts through the application of a CF, which is calculated based on a statutory formula by CMS' Office of the Actuary (OACT). The formula for calculating the Medicare PFS payment amount for a given service and fee schedule area can be expressed as:

Payment = [(RVU work × GPCI work) + (RVU PE × GPCI PE) + (RVU MP × GPCI MP)] × CF

3. Separate Fee Schedule Methodology for Anesthesia Services

Section 1848(b)(2)(B) of the Act specifies that the fee schedule amounts for anesthesia services are to be based on a uniform relative value guide, with appropriate adjustment of an anesthesia CF, in a manner to ensure that fee schedule amounts for anesthesia services are consistent with those for other services of comparable value. Therefore, there is a separate fee schedule methodology for anesthesia services. Specifically, we establish a separate CF for anesthesia services and we utilize the uniform relative value guide, or base units, as well as time units, to calculate the fee schedule amounts for anesthesia services. Since anesthesia services are not valued using RVUs, a separate methodology for locality adjustments is also necessary. This involves an adjustment to the national anesthesia CF for each payment locality.

B. Determination of PE RVUs

1. Overview

Practice expense (PE) is the portion of the resources used in furnishing a service that reflects the general categories of physician and practitioner expenses, such as office rent and personnel wages, but excluding MP expenses, as specified in section 1848(c)(1)(B) of the Act. As required by section 1848(c)(2)(C)(ii) of the Act, we use a resource-based system for determining PE RVUs for each physicians' service. We develop PE RVUs by considering the direct and indirect practice resources involved in furnishing each service. Direct expense categories include clinical labor, medical supplies, and medical equipment. Indirect expenses include administrative labor, office expense, and all other expenses. The sections that follow provide more detailed information about the methodology for translating the resources involved in furnishing each service into service-specific PE RVUs. We refer readers to the CY 2010 PFS final rule with comment period (74 FR 61743 through 61748) for a more detailed explanation of the PE methodology.

2. Practice Expense Methodology

a. Direct Practice Expense

We determine the direct PE for a specific service by adding the costs of the direct resources (that is, the clinical staff, medical supplies, and medical equipment) typically involved with furnishing that service. The costs of the resources are calculated using the refined direct PE inputs assigned to each CPT code in our PE database, which are generally based on our review of recommendations received from the RUC and those provided in response to public comment periods. For a detailed explanation of the direct PE methodology, including examples, we refer readers to the 5-year review of work RVUs under the PFS and proposed changes to the PE methodology CY 2007 PFS proposed notice (71 FR 37242) and the CY 2007 PFS final rule with comment period (71 FR 69629).

b. Indirect Practice Expense per Hour Data

We use survey data on indirect PEs incurred per hour worked, in developing the indirect portion of the PE RVUs. Prior to CY 2010, we primarily used the PE/HR by specialty that was obtained from the AMA's SMS. The AMA administered a new survey in CY 2007 and CY 2008, the Physician Practice Expense Information Survey (PPIS). The PPIS is a multispecialty, Start Printed Page 39108 nationally representative, PE survey of both physicians and NPPs paid under the PFS using a survey instrument and methods highly consistent with those used for the SMS and the supplemental surveys. The PPIS gathered information from 3,656 respondents across 51 physician specialty and health care professional groups. We believe the PPIS is the most comprehensive source of PE survey information available. We used the PPIS data to update the PE/HR data for the CY 2010 PFS for almost all of the Medicare-recognized specialties that participated in the survey.

When we began using the PPIS data in CY 2010, we did not change the PE RVU methodology itself or the manner in which the PE/HR data are used in that methodology. We only updated the PE/HR data based on the new survey. Furthermore, as we explained in the CY 2010 PFS final rule with comment period (74 FR 61751), because of the magnitude of payment reductions for some specialties resulting from the use of the PPIS data, we transitioned its use over a 4-year period from the previous PE RVUs to the PE RVUs developed using the new PPIS data. As provided in the CY 2010 PFS final rule with comment period (74 FR 61751), the transition to the PPIS data was complete for CY 2013. Therefore, PE RVUs from CY 2013 forward are developed based entirely on the PPIS data, except as noted in this section.

Section 1848(c)(2)(H)(i) of the Act requires us to use the medical oncology supplemental survey data submitted in 2003 for oncology drug administration services. Therefore, the PE/HR for medical oncology, hematology, and hematology/oncology reflects the continued use of these supplemental survey data.

Supplemental survey data on independent labs from the College of American Pathologists were implemented for payments beginning in CY 2005. Supplemental survey data from the National Coalition of Quality Diagnostic Imaging Services (NCQDIS), representing independent diagnostic testing facilities (IDTFs), were blended with supplementary survey data from the American College of Radiology (ACR) and implemented for payments beginning in CY 2007. Neither IDTFs, nor independent labs, participated in the PPIS. Therefore, we continue to use the PE/HR that was developed from their supplemental survey data.

Consistent with our past practice, the previous indirect PE/HR values from the supplemental surveys for these specialties were updated to CY 2006 using the Medicare Economic Index (MEI) to put them on a comparable basis with the PPIS data.

We also do not use the PPIS data for reproductive endocrinology and spine surgery since these specialties currently are not separately recognized by Medicare, nor do we have a method to blend the PPIS data with Medicare-recognized specialty data.

Previously, we established PE/HR values for various specialties without SMS or supplemental survey data by crosswalking them to other similar specialties to estimate a proxy PE/HR. For specialties that were part of the PPIS for which we previously used a crosswalked PE/HR, we instead used the PPIS-based PE/HR. We use crosswalks for specialties that did not participate in the PPIS. These crosswalks have been generally established through notice and comment rulemaking and are available in the file titled "CY 2022 PFS proposed rule PE/HR" on the CMS website under downloads for the CY 2022 PFS proposed rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

For CY 2022, we have incorporated the available utilization data for two new specialties, each of which became a recognized Medicare specialty during 2020. These specialties are Micrographic Dermatologic Surgery (MDS) and Adult Congenital Heart Disease (ACHD). We are proposing to use proxy PE/HR values for these new specialties, as there are no PPIS data for these specialties, by crosswalking the PE/HR as follows from specialties that furnish similar services in the Medicare claims data:

- Micrographic Dermatologic Surgery (MDS) from Dermatology; and

- Adult Congenital Heart Disease (ACHD from Cardiology.

These updates are reflected in the "CY 2022 PFS proposed rule PE/HR" file available on the CMS website under the supporting data files for the CY 2022 PFS proposed rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

c. Allocation of PE to Services

To establish PE RVUs for specific services, it is necessary to establish the direct and indirect PE associated with each service.

(1) Direct Costs

The relative relationship between the direct cost portions of the PE RVUs for any two services is determined by the relative relationship between the sum of the direct cost resources (that is, the clinical staff, medical supplies, and medical equipment) typically involved with furnishing each of the services. The costs of these resources are calculated from the refined direct PE inputs in our PE database. For example, if one service has a direct cost sum of $400 from our PE database and another service has a direct cost sum of $200, the direct portion of the PE RVUs of the first service would be twice as much as the direct portion of the PE RVUs for the second service.

(2) Indirect Costs

We allocate the indirect costs at the code level based on the direct costs specifically associated with a code and the greater of either the clinical labor costs or the work RVUs. We also incorporate the survey data described earlier in the PE/HR discussion. The general approach to developing the indirect portion of the PE RVUs is as follows:

- For a given service, we use the direct portion of the PE RVUs calculated as previously described and the average percentage that direct costs represent of total costs (based on survey data) across the specialties that furnish the service to determine an initial indirect allocator. That is, the initial indirect allocator is calculated so that the direct costs equal the average percentage of direct costs of those specialties furnishing the service. For example, if the direct portion of the PE RVUs for a given service is 2.00 and direct costs, on average, represent 25 percent of total costs for the specialties that furnish the service, the initial indirect allocator would be calculated so that it equals 75 percent of the total PE RVUs. Thus, in this example, the initial indirect allocator would equal 6.00, resulting in a total PE RVU of 8.00 (2.00 is 25 percent of 8.00 and 6.00 is 75 percent of 8.00).

- Next, we add the greater of the work RVUs or clinical labor portion of the direct portion of the PE RVUs to this initial indirect allocator. In our example, if this service had a work RVU of 4.00 and the clinical labor portion of the direct PE RVU was 1.50, we would add 4.00 (since the 4.00 work RVUs are greater than the 1.50 clinical labor portion) to the initial indirect allocator of 6.00 to get an indirect allocator of 10.00. In the absence of any further use of the survey data, the relative relationship between the indirect cost portions of the PE RVUs for any two services would be determined by the relative relationship between these indirect cost allocators. For example, if one service had an indirect cost allocator of 10.00 and another service had an indirect cost allocator of 5.00, Start Printed Page 39109 the indirect portion of the PE RVUs of the first service would be twice as great as the indirect portion of the PE RVUs for the second service.

- Then, we incorporate the specialty-specific indirect PE/HR data into the calculation. In our example, if, based on the survey data, the average indirect cost of the specialties furnishing the first service with an allocator of 10.00 was half of the average indirect cost of the specialties furnishing the second service with an indirect allocator of 5.00, the indirect portion of the PE RVUs of the first service would be equal to that of the second service.

(3) Facility and Nonfacility Costs

For procedures that can be furnished in a physician's office, as well as in a facility setting, where Medicare makes a separate payment to the facility for its costs in furnishing a service, we establish two PE RVUs: Facility and nonfacility. The methodology for calculating PE RVUs is the same for both the facility and nonfacility RVUs, but is applied independently to yield two separate PE RVUs. In calculating the PE RVUs for services furnished in a facility, we do not include resources that would generally not be provided by physicians when furnishing the service. For this reason, the facility PE RVUs are generally lower than the nonfacility PE RVUs.

(4) Services With Technical Components and Professional Components

Diagnostic services are generally comprised of two components: A professional component (PC); and a technical component (TC). The PC and TC may be furnished independently or by different providers, or they may be furnished together as a global service. When services have separately billable PC and TC components, the payment for the global service equals the sum of the payment for the TC and PC. To achieve this, we use a weighted average of the ratio of indirect to direct costs across all the specialties that furnish the global service, TCs, and PCs; that is, we apply the same weighted average indirect percentage factor to allocate indirect expenses to the global service, PCs, and TCs for a service. (The direct PE RVUs for the TC and PC sum to the global.)

(5) PE RVU Methodology

For a more detailed description of the PE RVU methodology, we refer readers to the CY 2010 PFS final rule with comment period (74 FR 61745 through 61746). We also direct readers to the file titled "Calculation of PE RVUs under Methodology for Selected Codes" which is available on our website under downloads for the CY 2022 PFS proposed rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html. This file contains a table that illustrates the calculation of PE RVUs as described in this proposed rule for individual codes.

(a) Setup File

First, we create a setup file for the PE methodology. The setup file contains the direct cost inputs, the utilization for each procedure code at the specialty and facility/nonfacility place of service level, and the specialty-specific PE/HR data calculated from the surveys.

(b) Calculate the Direct Cost PE RVUs

Sum the costs of each direct input.

Step 1: Sum the direct costs of the inputs for each service.

Step 2: Calculate the aggregate pool of direct PE costs for the current year. We set the aggregate pool of PE costs equal to the product of the ratio of the current aggregate PE RVUs to current aggregate work RVUs and the projected aggregate work RVUs.

Step 3: Calculate the aggregate pool of direct PE costs for use in ratesetting. This is the product of the aggregate direct costs for all services from Step 1 and the utilization data for that service.

Step 4: Using the results of Step 2 and Step 3, use the CF to calculate a direct PE scaling adjustment to ensure that the aggregate pool of direct PE costs calculated in Step 3 does not vary from the aggregate pool of direct PE costs for the current year. Apply the scaling adjustment to the direct costs for each service (as calculated in Step 1).

Step 5: Convert the results of Step 4 to a RVU scale for each service. To do this, divide the results of Step 4 by the CF. Note that the actual value of the CF used in this calculation does not influence the final direct cost PE RVUs as long as the same CF is used in Step 4 and Step 5. Different CFs would result in different direct PE scaling adjustments, but this has no effect on the final direct cost PE RVUs since changes in the CFs and changes in the associated direct scaling adjustments offset one another.

(c) Create the Indirect Cost PE RVUs

Create indirect allocators.

Step 6: Based on the survey data, calculate direct and indirect PE percentages for each physician specialty.

Step 7: Calculate direct and indirect PE percentages at the service level by taking a weighted average of the results of Step 6 for the specialties that furnish the service. Note that for services with TCs and PCs, the direct and indirect percentages for a given service do not vary by the PC, TC, and global service.

We generally use an average of the 3 most recent years of available Medicare claims data to determine the specialty mix assigned to each code. Codes with low Medicare service volume require special attention since billing or enrollment irregularities for a given year can result in significant changes in specialty mix assignment. We finalized a policy in the CY 2018 PFS final rule (82 FR 52982 through 59283) to use the most recent year of claims data to determine which codes are low volume for the coming year (those that have fewer than 100 allowed services in the Medicare claims data). For codes that fall into this category, instead of assigning specialty mix based on the specialties of the practitioners reporting the services in the claims data, we use the expected specialty that we identify on a list developed based on medical review and input from expert stakeholders. We display this list of expected specialty assignments as part of the annual set of data files we make available as part of notice and comment rulemaking and consider recommendations from the RUC and other stakeholders on changes to this list on an annual basis. Services for which the specialty is automatically assigned based on previously finalized policies under our established methodology (for example, "always therapy" services) are unaffected by the list of expected specialty assignments. We also finalized in the CY 2018 PFS final rule (82 FR 52982 through 59283) a policy to apply these service-level overrides for both PE and MP, rather than one or the other category.

Step 8: Calculate the service level allocators for the indirect PEs based on the percentages calculated in Step 7. The indirect PEs are allocated based on the three components: the direct PE RVUs; the clinical labor PE RVUs; and the work RVUs.

For most services the indirect allocator is: Indirect PE percentage * (direct PE RVUs/direct percentage) + work RVUs.

There are two situations where this formula is modified:

- If the service is a global service (that is, a service with global, professional, and technical components), then the indirect PE allocator is: Indirect percentage (direct PE RVUs/direct percentage) + clinical labor PE RVUs + work RVUs.

- If the clinical labor PE RVUs exceed the work RVUs (and the service is not a global service), then the indirect Start Printed Page 39110 allocator is: Indirect PE percentage (direct PE RVUs/direct percentage) + clinical labor PE RVUs.

(Note: For global services, the indirect PE allocator is based on both the work RVUs and the clinical labor PE RVUs. We do this to recognize that, for the PC service, indirect PEs would be allocated using the work RVUs, and for the TC service, indirect PEs would be allocated using the direct PE RVUs and the clinical labor PE RVUs. This also allows the global component RVUs to equal the sum of the PC and TC RVUs.)

For presentation purposes, in the examples in the download file titled "Calculation of PE RVUs under Methodology for Selected Codes", the formulas were divided into two parts for each service.

- The first part does not vary by service and is the indirect percentage (direct PE RVUs/direct percentage).

- The second part is either the work RVU, clinical labor PE RVU, or both depending on whether the service is a global service and whether the clinical PE RVUs exceed the work RVUs (as described earlier in this step).

Apply a scaling adjustment to the indirect allocators.

Step 9: Calculate the current aggregate pool of indirect PE RVUs by multiplying the result of step 8 by the average indirect PE percentage from the survey data.

Step 10: Calculate an aggregate pool of indirect PE RVUs for all PFS services by adding the product of the indirect PE allocators for a service from Step 8 and the utilization data for that service.

Step 11: Using the results of Step 9 and Step 10, calculate an indirect PE adjustment so that the aggregate indirect allocation does not exceed the available aggregate indirect PE RVUs and apply it to indirect allocators calculated in Step 8.

Calculate the indirect practice cost index.

Step 12: Using the results of Step 11, calculate aggregate pools of specialty-specific adjusted indirect PE allocators for all PFS services for a specialty by adding the product of the adjusted indirect PE allocator for each service and the utilization data for that service.

Step 13: Using the specialty-specific indirect PE/HR data, calculate specialty-specific aggregate pools of indirect PE for all PFS services for that specialty by adding the product of the indirect PE/HR for the specialty, the work time for the service, and the specialty's utilization for the service across all services furnished by the specialty.

Step 14: Using the results of Step 12 and Step 13, calculate the specialty-specific indirect PE scaling factors.

Step 15: Using the results of Step 14, calculate an indirect practice cost index at the specialty level by dividing each specialty-specific indirect scaling factor by the average indirect scaling factor for the entire PFS.

Step 16: Calculate the indirect practice cost index at the service level to ensure the capture of all indirect costs. Calculate a weighted average of the practice cost index values for the specialties that furnish the service. (Note: For services with TCs and PCs, we calculate the indirect practice cost index across the global service, PCs, and TCs. Under this method, the indirect practice cost index for a given service (for example, echocardiogram) does not vary by the PC, TC, and global service.)

Step 17: Apply the service level indirect practice cost index calculated in Step 16 to the service level adjusted indirect allocators calculated in Step 11 to get the indirect PE RVUs.

(d) Calculate the Final PE RVUs

Step 18: Add the direct PE RVUs from Step 5 to the indirect PE RVUs from Step 17 and apply the final PE budget neutrality (BN) adjustment. The final PE BN adjustment is calculated by comparing the sum of steps 5 and 17 to the aggregate work RVUs scaled by the ratio of current aggregate PE and work RVUs. This adjustment ensures that all PE RVUs in the PFS account for the fact that certain specialties are excluded from the calculation of PE RVUs but included in maintaining overall PFS budget neutrality. (See "Specialties excluded from ratesetting calculation" later in this final rule.)

Step 19: Apply the phase-in of significant RVU reductions and its associated adjustment. Section 1848(c)(7) of the Act specifies that for services that are not new or revised codes, if the total RVUs for a service for a year would otherwise be decreased by an estimated 20 percent or more as compared to the total RVUs for the previous year, the applicable adjustments in work, PE, and MP RVUs shall be phased in over a 2-year period. In implementing the phase-in, we consider a 19 percent reduction as the maximum 1-year reduction for any service not described by a new or revised code. This approach limits the year one reduction for the service to the maximum allowed amount (that is, 19 percent), and then phases in the remainder of the reduction. To comply with section 1848(c)(7) of the Act, we adjust the PE RVUs to ensure that the total RVUs for all services that are not new or revised codes decrease by no more than 19 percent, and then apply a relativity adjustment to ensure that the total pool of aggregate PE RVUs remains relative to the pool of work and MP RVUs. For a more detailed description of the methodology for the phase-in of significant RVU changes, we refer readers to the CY 2016 PFS final rule with comment period (80 FR 70927 through 70931).

(e) Setup File Information

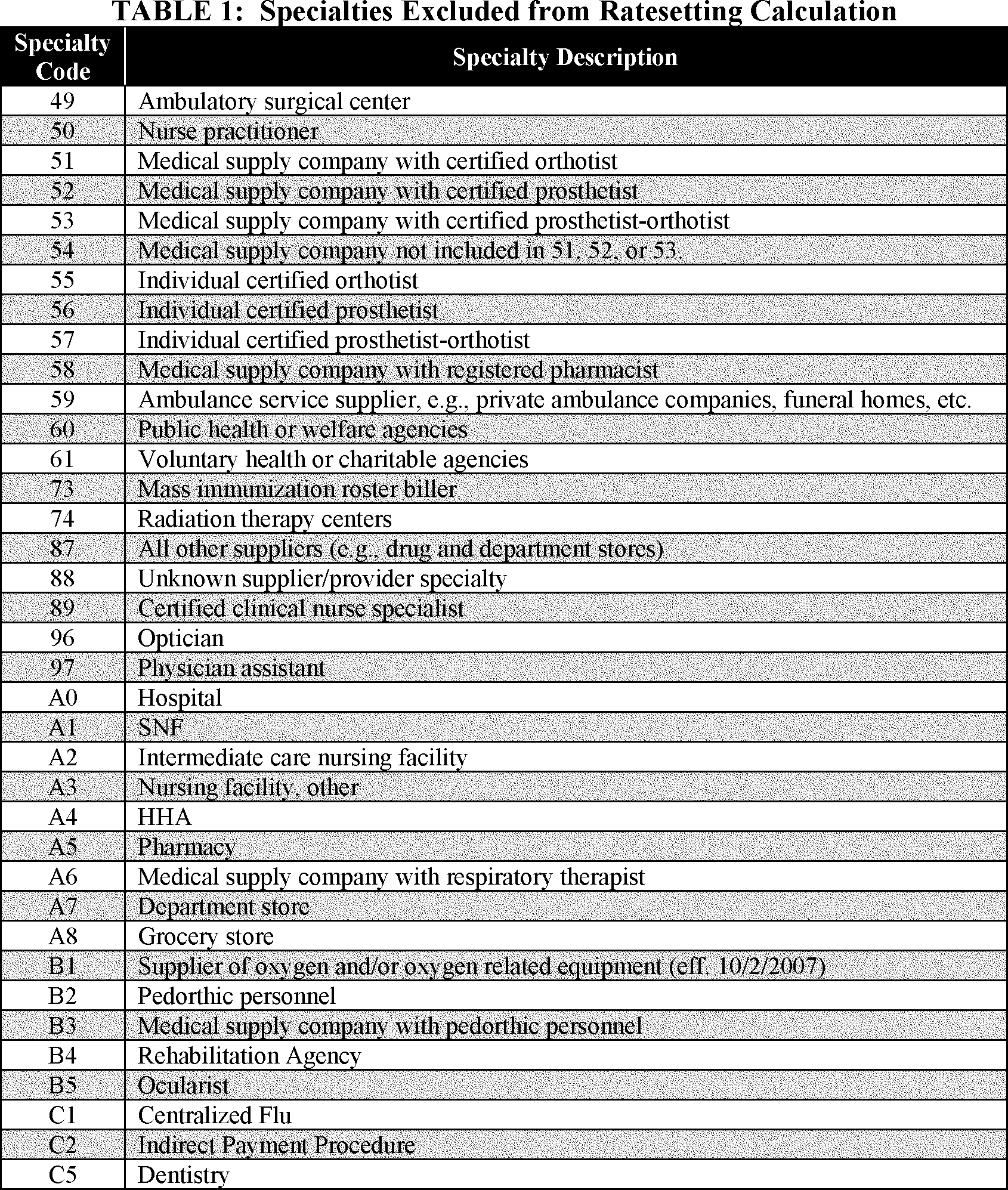

- Specialties excluded from ratesetting calculation: For the purposes of calculating the PE and MP RVUs, we exclude certain specialties, such as certain NPPs paid at a percentage of the PFS and low-volume specialties, from the calculation. These specialties are included for the purposes of calculating the BN adjustment. They are displayed in Table 1.

Start Printed Page 39111

- Crosswalk certain low volume physician specialties: Crosswalk the utilization of certain specialties with relatively low PFS utilization to the associated specialties.

- Physical therapy utilization: Crosswalk the utilization associated with all physical therapy services to the specialty of physical therapy.

- Identify professional and technical services not identified under the usual TC and 26 modifiers: Flag the services that are PC and TC services but do not use TC and 26 modifiers (for example, electrocardiograms). This flag associates the PC and TC with the associated global code for use in creating the indirect PE RVUs. For example, the professional service, CPT code 93010 (Electrocardiogram, routine ECG with at least 12 leads; interpretation and report only), is associated with the global service, CPT code 93000 (Electrocardiogram, routine ECG with at least 12 leads; with interpretation and report).

- Payment modifiers: Payment modifiers are accounted for in the creation of the file consistent with current payment policy as implemented in claims processing. For example, services billed with the assistant at surgery modifier are paid 16 percent of the PFS amount for that service; therefore, the utilization file is modified to only account for 16 percent of any service that contains the assistant at surgery modifier. Similarly, for those services to which volume adjustments are made to account for the payment modifiers, time adjustments are applied as well. For time adjustments to surgical services, the intraoperative portion in the work time file is used; where it is not present, the intraoperative percentage from the payment files used by contractors to process Medicare claims is used instead. Where neither is available, we use the payment adjustment ratio to adjust the time accordingly. Table 2 details the manner in which the modifiers are applied.

Start Printed Page 39112

We also make adjustments to volume and time that correspond to other payment rules, including special multiple procedure endoscopy rules and multiple procedure payment reductions (MPPRs). We note that section 1848(c)(2)(B)(v) of the Act exempts certain reduced payments for multiple imaging procedures and multiple therapy services from the BN calculation under section 1848(c)(2)(B)(ii)(II) of the Act. These MPPRs are not included in the development of the RVUs.

Beginning in CY 2022, section 1834(v)(1) of the Act requires that we apply a 15 percent payment reduction for outpatient occupational therapy services and outpatient physical therapy services that are provided, in whole or in part, by a physical therapist assistant (PTA) or occupational therapy assistant (OTA). Section 1834(v)(2)(A) of the Act required CMS to establish modifiers to identify these services, which we did in the CY 2019 PFS final rule (83 FR 59654 through 59661), creating the CQ and CO payment modifiers for services provided in whole or in part by PTAs and OTAs, respectively. These payment modifiers are required to be used on claims for services with dates of service beginning January 1, 2020, as specified in the CY 2020 PFS final rule (84 FR 62702 through 62708). We will apply the 15 percent payment reduction to therapy services provided by PTAs (using the CQ modifier) or OTAs (using the CO modifier), as required by statute. Under sections 1834(k) and 1848 of the Act, payment is made for outpatient therapy services at 80 percent of the lesser of the actual charge or applicable fee schedule amount (the allowed charge). The remaining 20 percent is the beneficiary copayment. For therapy services to which the new discount applies, payment will be made at 85 percent of the 80 percent of allowed charges. Therefore, the volume discount factor for therapy services to which the CQ and CO modifiers apply is: (0.20 + (0.80* 0.85), which equals 88 percent.

For anesthesia services, we do not apply adjustments to volume since we use the average allowed charge when simulating RVUs; therefore, the RVUs as calculated already reflect the payments as adjusted by modifiers, and no volume adjustments are necessary. However, a time adjustment of 33 percent is made only for medical direction of two to four cases since that is the only situation where a single practitioner is involved with multiple beneficiaries concurrently, so that counting each service without regard to the overlap with other services would overstate the amount of time spent by the practitioner furnishing these services.

- Work RVUs: The setup file contains the work RVUs from this final rule.

(6) Equipment Cost per Minute

The equipment cost per minute is calculated as:

(1/(minutes per year * usage)) * price * ((interest rate/(1−(1/((1 + interest rate)∧ life of equipment)))) + maintenance)

Where:

minutes per year = maximum minutes per year if usage were continuous (that is, usage = 1); generally 150,000 minutes.

usage = variable, see discussion below in this proposed rule.

price = price of the particular piece of equipment.

life of equipment = useful life of the particular piece of equipment.

maintenance = factor for maintenance; 0.05.

interest rate = variable, see discussion below in this proposed rule.

Usage: We currently use an equipment utilization rate assumption of 50 percent for most equipment, with the exception of expensive diagnostic imaging equipment, for which we use a 90 percent assumption as required by section 1848(b)(4)(C) of the Act.

Useful Life: In the CY 2005 PFS final rule we stated that we updated the useful life for equipment items primarily based on the AHA's "Estimated Useful Lives of Depreciable Hospital Assets" guidelines (69 FR 66246). The most recent edition of these guidelines was published in 2018. This reference material provides an estimated useful life for hundreds of different types of equipment, the vast majority of which fall in the range of 5 to 10 years, and none of which are lower than 2 years in duration. We believe that the updated editions of this reference material remain the most accurate source for estimating the useful life of depreciable medical equipment. Start Printed Page 39113

In the CY 2021 PFS final rule, we finalized a proposal to treat equipment life durations of less than 1 year as having a duration of 1 year for the purpose of our equipment price per minute formula. In the rare cases where items are replaced every few months, we noted that we believe it is more accurate to treat these items as disposable supplies with a fractional supply quantity as opposed to equipment items with very short equipment life durations. For a more detailed discussion of the methodology associated with very short equipment life durations, we refer readers to the CY 2021 PFS final rule (85 FR 84482 through 84483).

- Maintenance: We finalized the 5 percent factor for annual maintenance in the CY 1998 PFS final rule with comment period (62 FR 33164). As we previously stated in the CY 2016 PFS final rule with comment period (80 FR 70897), we do not believe the annual maintenance factor for all equipment is precisely 5 percent, and we concur that the current rate likely understates the true cost of maintaining some equipment. We also noted that we believe it likely overstates the maintenance costs for other equipment. When we solicited comments regarding sources of data containing equipment maintenance rates, commenters were unable to identify an auditable, robust data source that could be used by CMS on a wide scale. We noted that we did not believe voluntary submissions regarding the maintenance costs of individual equipment items would be an appropriate methodology for determining costs. As a result, in the absence of publicly available datasets regarding equipment maintenance costs or another systematic data collection methodology for determining a different maintenance factor, we did not propose a variable maintenance factor for equipment cost per minute pricing as we did not believe that we have sufficient information at present. We noted that we would continue to investigate potential avenues for determining equipment maintenance costs across a broad range of equipment items.

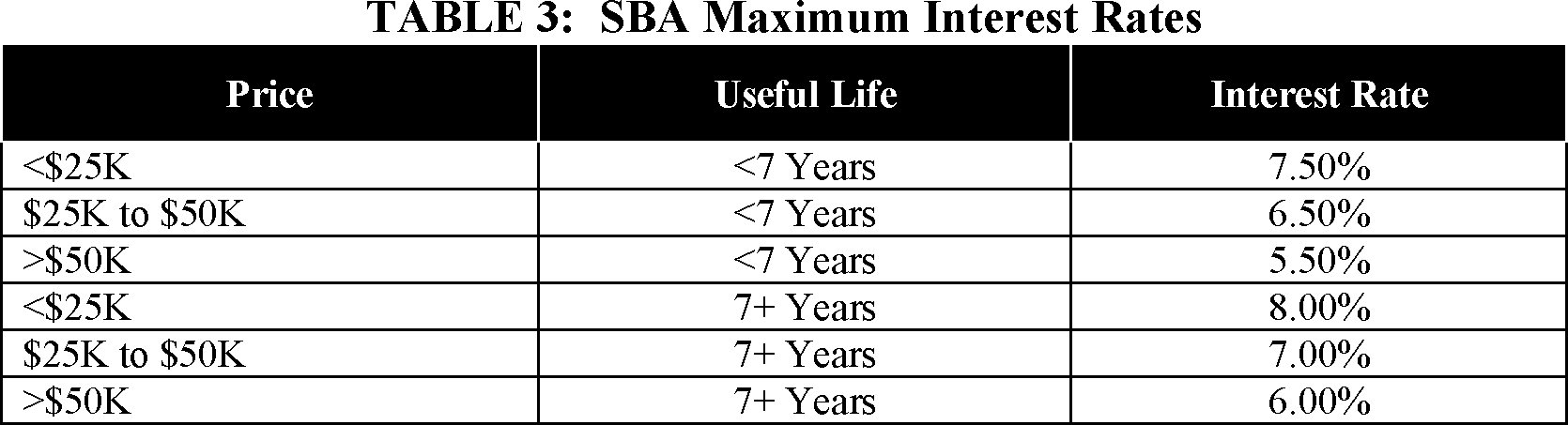

- Interest Rate: In the CY 2013 PFS final rule with comment period (77 FR 68902), we updated the interest rates used in developing an equipment cost per minute calculation (see 77 FR 68902 for a thorough discussion of this issue). The interest rate was based on the Small Business Administration (SBA) maximum interest rates for different categories of loan size (equipment cost) and maturity (useful life). The Interest rates are listed in Table 3.

We are not proposing any changes to the equipment interest rates for CY 2022.

3. Changes to Direct PE Inputs for Specific Services

This section focuses on specific PE inputs. The direct PE inputs are included in the CY 2022 direct PE input public use files, which are available on the CMS website under downloads for the CY 2022 PFS proposed rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

a. Standardization of Clinical Labor Tasks

As we noted in the CY 2015 PFS final rule with comment period (79 FR 67640 through 67641), we continue to make improvements to the direct PE input database to provide the number of clinical labor minutes assigned for each task for every code in the database instead of only including the number of clinical labor minutes for the preservice, service, and post service periods for each code. In addition to increasing the transparency of the information used to set PE RVUs, this level of detail would allow us to compare clinical labor times for activities associated with services across the PFS, which we believe is important to maintaining the relativity of the direct PE inputs. This information would facilitate the identification of the usual numbers of minutes for clinical labor tasks and the identification of exceptions to the usual values. It would also allow for greater transparency and consistency in the assignment of equipment minutes based on clinical labor times. Finally, we believe that the detailed information can be useful in maintaining standard times for particular clinical labor tasks that can be applied consistently to many codes as they are valued over several years, similar in principle to the use of physician preservice time packages. We believe that setting and maintaining such standards would provide greater consistency among codes that share the same clinical labor tasks and could improve relativity of values among codes. For example, as medical practice and technologies change over time, changes in the standards could be updated simultaneously for all codes with the applicable clinical labor tasks, instead of waiting for individual codes to be reviewed.

In the CY 2016 PFS final rule with comment period (80 FR 70901), we solicited comments on the appropriate standard minutes for the clinical labor tasks associated with services that use digital technology. After consideration of comments received, we finalized standard times for clinical labor tasks associated with digital imaging at 2 minutes for "Availability of prior images confirmed", 2 minutes for "Patient clinical information and questionnaire reviewed by technologist, order from physician confirmed and exam protocoled by radiologist", 2 minutes for "Review examination with interpreting MD", and 1 minute for "Exam documents scanned into PACS" and "Exam completed in RIS system to generate billing process and to populate images into Radiologist work queue." In the CY 2017 PFS final rule (81 FR 80184 through 80186), we finalized a policy to establish a range of appropriate standard minutes for the clinical labor activity, "Technologist QCs images in PACS, checking for all images, reformats, and dose page." These standard minutes will be applied to new and revised Start Printed Page 39114 codes that make use of this clinical labor activity when they are reviewed by us for valuation. We finalized a policy to establish 2 minutes as the standard for the simple case, 3 minutes as the standard for the intermediate case, 4 minutes as the standard for the complex case, and 5 minutes as the standard for the highly complex case. These values were based upon a review of the existing minutes assigned for this clinical labor activity; we determined that 2 minutes is the duration for most services and a small number of codes with more complex forms of digital imaging have higher values. We also finalized standard times for a series of clinical labor tasks associated with pathology services in the CY 2016 PFS final rule with comment period (80 FR 70902). We do not believe these activities would be dependent on number of blocks or batch size, and we believe that the finalized standard values accurately reflect the typical time it takes to perform these clinical labor tasks.

In reviewing the RUC-recommended direct PE inputs for CY 2019, we noticed that the 3 minutes of clinical labor time traditionally assigned to the "Prepare room, equipment and supplies" (CA013) clinical labor activity were split into 2 minutes for the "Prepare room, equipment and supplies" activity and 1 minute for the "Confirm order, protocol exam" (CA014) activity. We proposed to maintain the 3 minutes of clinical labor time for the "Prepare room, equipment and supplies" activity and remove the clinical labor time for the "Confirm order, protocol exam" activity wherever we observed this pattern in the RUC-recommended direct PE inputs. Commenters explained in response that when the new version of the PE worksheet introduced the activity codes for clinical labor, there was a need to translate old clinical labor tasks into the new activity codes, and that a prior clinical labor task was split into two of the new clinical labor activity codes: CA007 (Review patient clinical extant information and questionnaire) in the preservice period, and CA014 (Confirm order, protocol exam) in the service period. Commenters stated that the same clinical labor from the old PE worksheet was now divided into the CA007 and CA014 activity codes, with a standard of 1 minute for each activity. We agreed with commenters that we would finalize the RUC-recommended 2 minutes of clinical labor time for the CA007 activity code and 1 minute for the CA014 activity code in situations where this was the case. However, when reviewing the clinical labor for the reviewed codes affected by this issue, we found that several of the codes did not include this old clinical labor task, and we also noted that several of the reviewed codes that contained the CA014 clinical labor activity code did not contain any clinical labor for the CA007 activity. In these situations, we continue to believe that in these cases, the 3 total minutes of clinical staff time would be more accurately described by the CA013 "Prepare room, equipment and supplies" activity code, and we finalized these clinical labor refinements. For additional details, we direct readers to the discussion in the CY 2019 PFS final rule (83 FR 59463 and 59464).

Following the publication of the CY 2020 PFS proposed rule, a commenter expressed concern with the published list of common refinements to equipment time. The commenter stated that these refinements were the formulaic result of the applying refinements to the clinical labor time and did not constitute separate refinements; the commenter requested that CMS no longer include these refinements in the table published each year. In the CY 2020 PFS final rule, we agreed with the commenter that these equipment time refinements did not reflect errors in the equipment recommendations or policy discrepancies with the RUC's equipment time recommendations. However, we believed that it was important to publish the specific equipment times that we were proposing (or finalizing in the case of the final rule) when they differed from the recommended values due to the effect that these changes can have on the direct costs associated with equipment time. Therefore, we finalized the separation of the equipment time refinements associated with changes in clinical labor into a separate table of refinements. For additional details, we direct readers to the discussion in the CY 2020 PFS final rule (84 FR 62584).

Historically, the RUC has submitted a "PE worksheet" that details the recommended direct PE inputs for our use in developing PE RVUs. The format of the PE worksheet has varied over time and among the medical specialties developing the recommendations. These variations have made it difficult for both the RUC's development and our review of code values for individual codes. Beginning with its recommendations for CY 2019, the RUC has mandated the use of a new PE worksheet for purposes of their recommendation development process that standardizes the clinical labor tasks and assigns them a clinical labor activity code. We believe the RUC's use of the new PE worksheet in developing and submitting recommendations will help us to simplify and standardize the hundreds of different clinical labor tasks currently listed in our direct PE database. As we did in previous calendar years, to facilitate rulemaking for CY 2022, we are continuing to display two versions of the Labor Task Detail public use file: one version with the old listing of clinical labor tasks, and one with the same tasks crosswalked to the new listing of clinical labor activity codes. These lists are available on the CMS website under downloads for the CY 2022 PFS proposed rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

b. Technical Corrections to Direct PE Input Database and Supporting Files

For CY 2022, we are proposing to address the following:

- Following the publication of the CY 2021 PFS proposed rule, several commenters questioned the proposed RVUs associated with several occupational therapy evaluation procedures (CPT codes 97165 through 97167). Commenters stated that the PE valuation for these codes appeared to be illogical as it was counterintuitive for the PE RVU to go down as the level of complexity increased. Commenters stated that the distribution of code usage has not changed in any manner to justify a reduction in the code values and that all three evaluation codes should reimburse at the same rate. In response to the commenters, we noted that although the three codes in question shared the same work RVU and the same direct PE inputs, they did not share the same specialty distribution in the claims data and therefore would not necessarily receive the same allocation of indirect PE. In the CY 2021 PFS final rule (85 FR 84490), we finalized the implementation of a technical change intended to ensure that these three services received the same allocation of indirect PE. We agreed with commenters that it was important to avoid a potential rank order anomaly in which the simple case for a service was valued higher than the complex case.

After the publication of the CY 2021 PFS final rule, stakeholders stated their appreciation for the technical change made in the final rule to ensure that the indirect PE allocation was the same for all three levels of occupational therapy evaluation codes. However, stakeholders expressed concern that the PE RVUs we finalized for CPT codes Start Printed Page 39115 97165-97167 decreased as compared to the PE RVUs we proposed for CY 2021. Stakeholders stated that nothing had occurred in the past year that would account for a reduction to the proposed PE for these codes, especially in a year where the proposed PE increased for the corresponding physical therapy evaluation procedures (CPT codes 97161-97163), and stakeholders questioned whether there had been an error in applying the indirect PE methodology.

We reviewed the indirect PE allocation for CPT codes 97165-97167 in response to the stakeholder inquiry and we do not agree that there was an error in applying the indirect PE methodology. We finalized a technical change in the CY 2021 PFS final rule intended to ensure that these three services received the same allocation of indirect PE, which achieved its desired goal of assigning equivalent indirect PE to these three services. However, by forcing CPT codes 97165-97167 to have the same indirect PE allocation, the indirect PE values for these codes no longer relied on the claims data, which ended up affecting the indirect practice cost index for the wider occupational therapy specialty. Because CPT codes 97165-97167 are high volume services, this resulted in a lower indirect practice cost index for the occupational therapy specialty and a smaller allocation of indirect PE for CY 2021 than initially proposed.

We are addressing this issue for CY 2022 by proposing to assign all claims data associated with CPT codes 97165-97167 to the occupational therapy specialty. This should ensure that CPT codes 97165-97167 would always receive the same indirect PE allocation as well as preventing any fluctuations to the indirect practice cost index for the wider occupational therapy specialty. This proposal is intended to avoid a potential rank order anomaly in which the simple case for a service is valued higher than the complex case. As the utilization for CPT codes 97165-97167 is overwhelmingly identified as performed by occupational therapists, we do not anticipate that assigning all of the claims data for these codes to the occupational therapy specialty will have a noticeable effect on their valuation. We are soliciting public comments regarding this proposal, and specifically on what commenters suggest as the most appropriate method of assigning indirect PE allocation for these services.

- In the CY 2020 PFS final rule (84 FR 63102 through 63104), we created two new HCPCS G codes, G2082 and G2083, effective January 1, 2020 on an interim final basis for the provision of self-administered esketamine. In the CY 2021 PFS final rule, we finalized a proposal to refine the values for HCPCS codes G2082 and G2083 using a building block methodology that summed the values associated with several codes (85 FR 84641 through 84642). Following the publication of the CY 2021 PFS final rule, stakeholders expressed their concern that the finalized PE RVU had decreased for HCPCS codes G2082 and G2083 as compared to the proposed valuation and as compared to the previous CY 2020 interim final valuation. Stakeholders questioned whether there had been an error in the PE allocation since CMS had finalized increases in the direct PE inputs for the services.

We reviewed the indirect PE allocation for HCPCS codes G2082 and G2083 in response to the stakeholder inquiry and discovered a technical change that was applied in error. Specifically, we inadvertently assigned a different physician specialty than we intended ("All Physicians") to HCPCS codes G2082 and G2083 for indirect PE allocation in our ratesetting process during valuation of these codes in the CY 2020 PFS final rule, and continued that assignment into the CY 2021 PFS proposed rule. This specialty assignment caused the PE value for these services to be higher than anticipated for CY 2020. We intended to revise the assigned physician specialty for these codes to "General Practice" in the CY 2021 PFS final rule; however, we neglected to discuss this change in the course of PFS rulemaking for CY 2021. Since we initially applied this technical change in the CY 2021 PFS final rule without providing an explanation, we issued a correction notice (86 FR 14690) to remove this change from the CY 2021 PFS final rule, and to instead maintain the All Physicians specialty assignment through CY 2021. We apologize for any confusion this may have caused.

For CY 2022, we are proposing to maintain the currently assigned physician specialty for indirect PE allocation for HCPCS codes G2082 and G2083. We are proposing to assign these two services to the All Physicians specialty for indirect PE allocation which will maintain payment consistency with the rates published in the CY 2020 PFS final rule and the CY 2021 PFS proposed rule. Although we had previously intended to assign the General Practice specialty to these codes, stakeholders have provided additional information about these services suggesting that maintaining the All Physicians specialty assignment for these codes will help maintain payment stability and preserve access to this care for beneficiaries. We are soliciting public comments to help us discern which specialty would be the most appropriate to use for indirect PE allocation for HCPCS codes G2082 and G2083. We note that the PE methodology, which relies on the allocation of indirect costs based on the magnitude of direct costs, should appropriately reflect the typical costs for the specialty the commenters suggest. For example, we do not believe it would be appropriate to assign the Psychiatry specialty for these services given that HCPCS codes G2082 and G2083 include the high direct costs associated with esketamine supplies. The Psychiatry specialty is an outlier compared to most other specialties, allocating indirect costs at a 15:1 ratio based on direct costs because psychiatry services typically have very low direct costs. Assignment of most other specialties would result in allocation of direct costs at roughly a 3:1 ratio. We request that commenters explain in their comments how the indirect PE allocation would affect the payment for these services. Specifically, to ensure appropriate payment for HCPCS codes G2082 and G2083, we would like to get a better understanding of the indirect costs associated with these services, relative to other services furnished by the suggested specialty.

- A stakeholder contacted us regarding a potential error involving the intraservice work time for CPT code 35860 (Exploration for postoperative hemorrhage, thrombosis or infection; extremity). The stakeholder stated that the RUC recommended an intraservice work time of 90 minutes for this code when it was last reviewed in the CY 2012 PFS final rule and we finalized the work time without refinement at 60 minutes (76 FR 73131). The stakeholder requested that the intraservice work time for CPT code 35860 should be updated to 90 minutes.

We reviewed the intraservice work time for CPT code 35860 and found that the RUC inadvertently recommended a time of 60 minutes for the code, which we proposed and finalized without comment in rulemaking for the CY 2012 PFS. As a result, we do not believe that this is a technical error on our part. However, since the stakeholder has clarified that the RUC intended to recommend 90 minutes of intraservice work time for CPT code 35860 based on the surveyed median time, we are proposing to update the intraservice work time to 90 minutes to match the survey results. Start Printed Page 39116

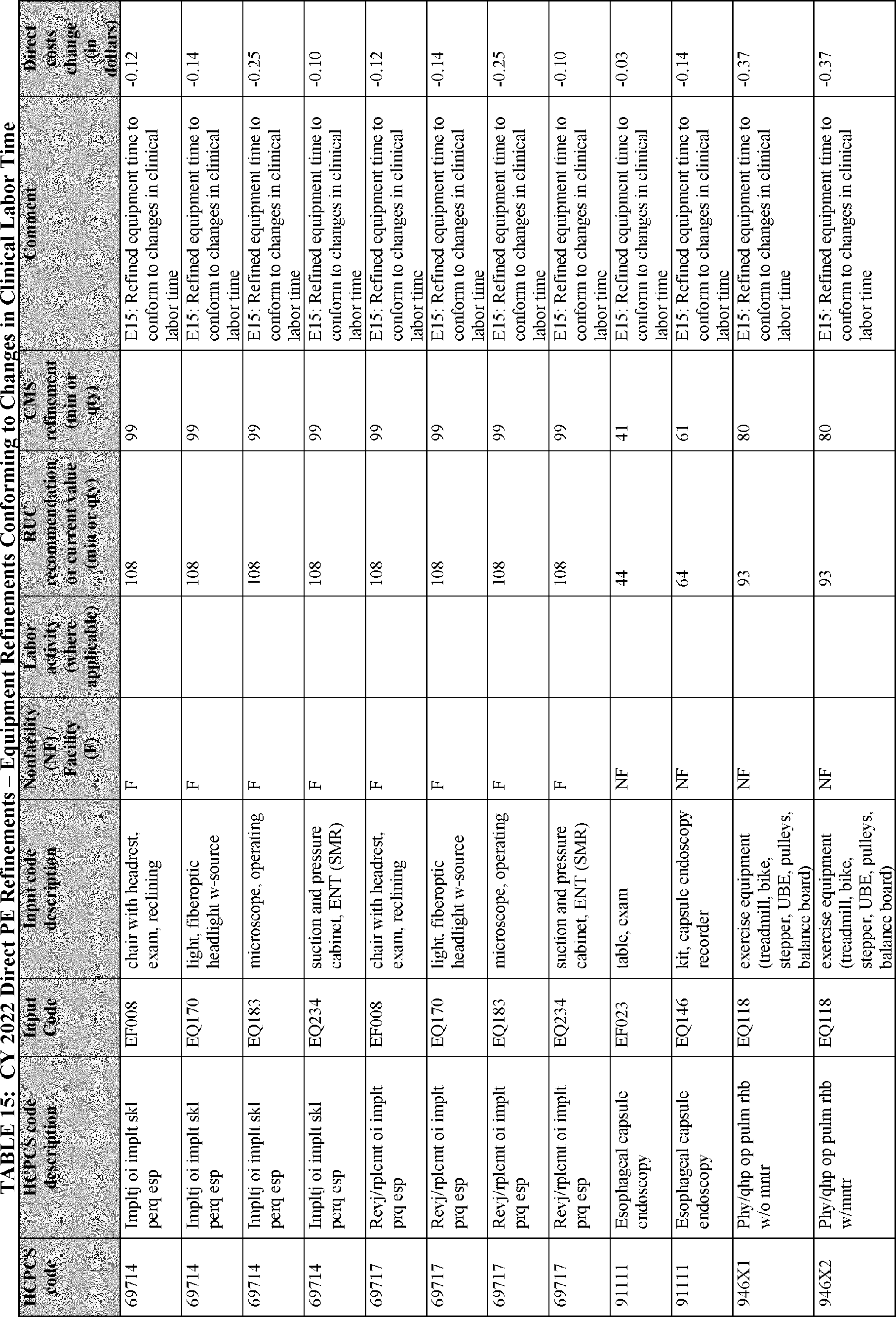

c. Updates to Prices for Existing Direct PE Inputs

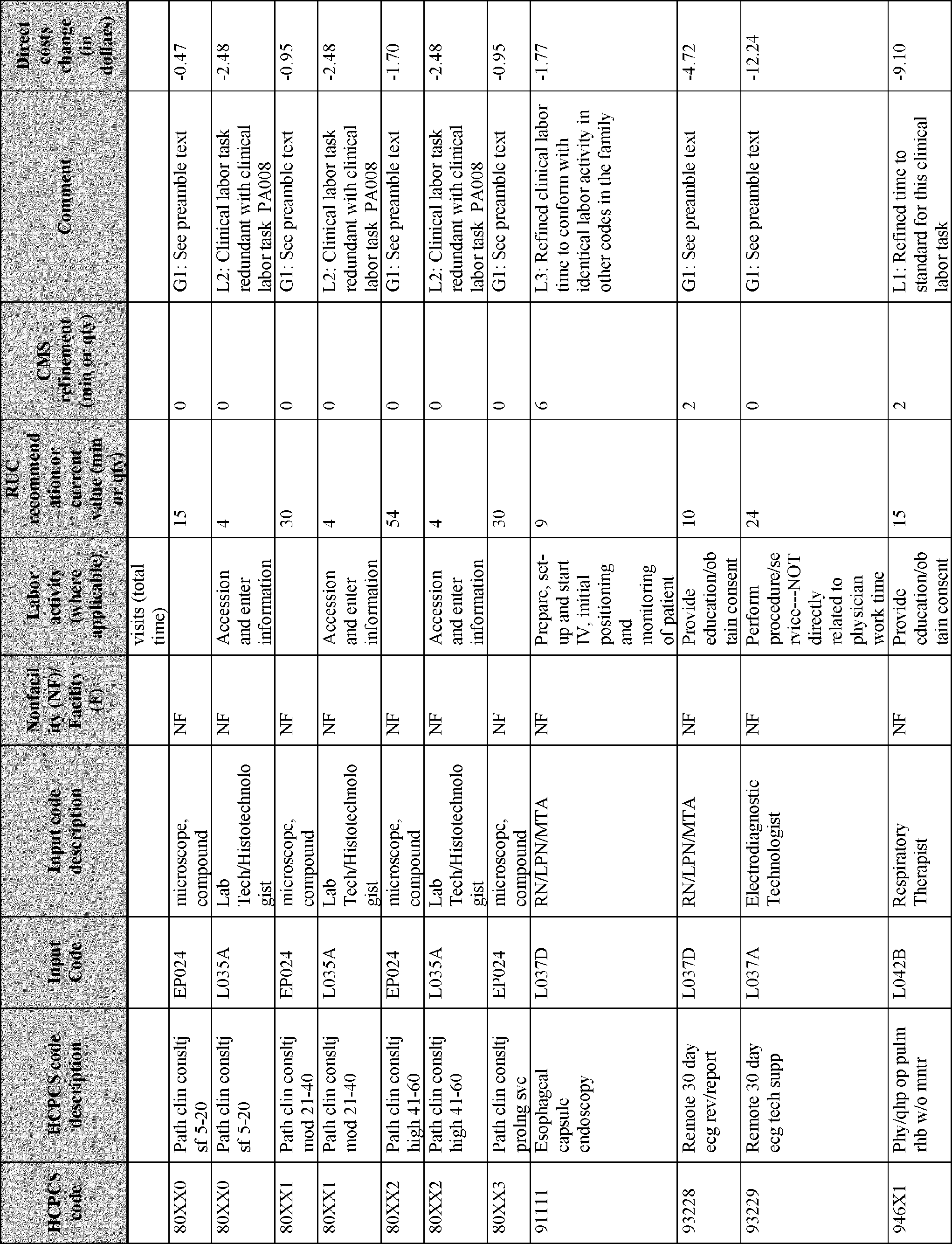

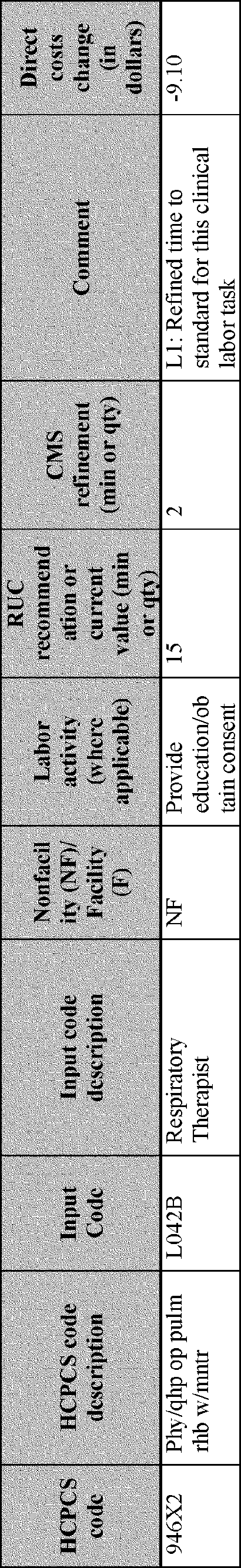

In the CY 2011 PFS final rule with comment period (75 FR 73205), we finalized a process to act on public requests to update equipment and supply price and equipment useful life inputs through annual rulemaking, beginning with the CY 2012 PFS proposed rule. For CY 2022, we are proposing to update the price of six supplies and two equipment items in response to the public submission of invoices. Since this is the final year of the supply and equipment pricing update, the new pricing for each of these supply and equipment items will take effect for CY 2022 as there are no remaining years of the transition. The six supply and equipment items with proposed updated prices are listed in the valuation of specific codes section of the preamble under Table 16: CY 2022 Invoices Received for Existing Direct PE Inputs.

(1) Market-Based Supply and Equipment Pricing Update

Section 220(a) of the Protecting Access to Medicare Act of 2014 (PAMA) (Pub. L. 113-93, April 1, 2014) provides that the Secretary may collect or obtain information from any eligible professional or any other source on the resources directly or indirectly related to furnishing services for which payment is made under the PFS, and that such information may be used in the determination of relative values for services under the PFS. Such information may include the time involved in furnishing services; the amounts, types and prices of PE inputs; overhead and accounting information for practices of physicians and other suppliers, and any other elements that would improve the valuation of services under the PFS.

As part of our authority under section 1848(c)(2)(M) of the Act, we initiated a market research contract with StrategyGen to conduct an in-depth and robust market research study to update the PFS direct PE inputs (DPEI) for supply and equipment pricing for CY 2019. These supply and equipment prices were last systematically developed in 2004-2005. StrategyGen submitted a report with updated pricing recommendations for approximately 1300 supplies and 750 equipment items currently used as direct PE inputs. This report is available as a public use file displayed on the CMS website under downloads for the CY 2019 PFS final rule at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

The StrategyGen team of researchers, attorneys, physicians, and health policy experts conducted a market research study of the supply and equipment items currently used in the PFS direct PE input database. Resources and methodologies included field surveys, aggregate databases, vendor resources, market scans, market analysis, physician substantiation, and statistical analysis to estimate and validate current prices for medical equipment and medical supplies. StrategyGen conducted secondary market research on each of the 2,072 DPEI medical equipment and supply items that CMS identified from the current DPEI. The primary and secondary resources StrategyGen used to gather price data and other information were:

- Telephone surveys with vendors for top priority items (Vendor Survey).

- Physician panel validation of market research results, prioritized by total spending (Physician Panel).

- The General Services Administration system (GSA).

- An aggregate health system buyers database with discounted prices (Buyers).

- Publicly available vendor resources, that is, Amazon Business, Cardinal Health (Vendors).

- The Federal Register, current DPEI data, historical proposed and final rules prior to CY 2018, and other resources; that is, AMA RUC reports (References).

StrategyGen prioritized the equipment and supply research based on current share of PE RVUs attributable by item provided by CMS. StrategyGen developed the preliminary Recommended Price (RP) methodology based on the following rules in hierarchical order considering both data representativeness and reliability.

(1) If the market share, as well as the sample size, for the top three commercial products were available, the weighted average price (weighted by percent market share) was the reported RP. Commercial price, as a weighted average of market share, represents a more robust estimate for each piece of equipment and a more precise reference for the RP.

(2) If no data were available for commercial products, the current CMS prices were used as the RP.